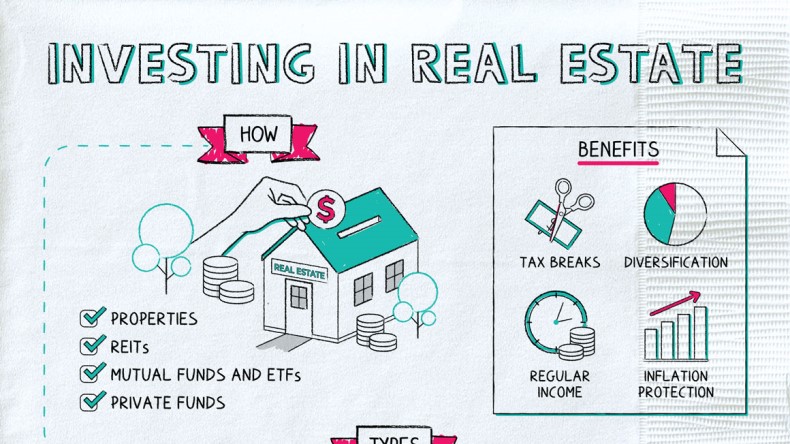

Investing in Real-estate For Novices

Real-estate purchase has long been accepted as a proven means for developing riches, however novices might find it daunting to browse through its complexities and create sustained results.

Novices trying to reach their economic goals can check out beginner-helpful making an investment tactics using our suggestions, referrals and language to have them underway.

1. Real Estate Expense Trusts (REITs)

REITs offer buyers an alternative way of purchasing real-estate without having the high launch funds necessary to purchase home straight, with reduced initial ventures than specifically acquiring real-estate specifically. REITs are businesses that own, work or finance income-making real estate property across numerous businesses - typically publicly dealt - delivering buyers with diversified real estate property resources at reduced lowest investment quantities than acquiring specific properties specifically. Investors can make either value REITs which own actual physical real estate property specifically themselves mortgage REITs which maintain financial loans on real-estate or crossbreed REITs which commit both varieties.REITs provides your portfolio with diversification advantages since they have decrease correlations to stocks and bonds than their classic brethren, even though they're not economic downturn-proof it is therefore a good idea to speak to your financial advisor about how much of your profile ought to be committed to REITs based upon your danger tolerance and goals.

These REITs give investors a chance to profit through dividends which can be taxed as inventory benefits, but brokers should be aware that REIT dividends can be impacted by factors like transforming rates of interest and variances in the real estate marketplace.

Depending on the type of REIT you pick out, it is essential which you investigation its financial history and present performance using SEC's EDGAR system. Prior to making a choice to buy or offer REIT reveals, seek advice from an authorized agent or monetary expert who are able to offer updated marketplace intelligence and information a knowledgeable determination - this way ensuring you're receiving ideal wholesaleing profits in your investments.

2. Real Estate Property Purchase Teams (REIGs)

As a newbie to property shelling out, the knowledge could be both pricey and intimidating. By signing up for a REIG you own an chance to swimming pool area both time and money with many other investors in order to acquire profits swiftly with minimal function necessary on your part. REIGs can be obtained both locally or on a federal size and operate differently some charge membership charges while others don't also, different REIGs call for various quantities of member contribution with a few getting one coordinator who handles everything when other may run more as relationships.Whichever REIG you choose, it is actually vitally important to perform extensive study prior to committing. This can require performing interview and asking them questions of business staff as well as looking at previous profits. You need to overview what investment method your REIG pursues - are they centered on flipping properties rapidly or could they be considering long-term cashflow era through leasing residence possession?

As with any sort of expenditure, REIGs may either reward or cause harm to you financially to find one appropriate for your special financial predicament and danger endurance is key.

If you're interested in enrolling in a REIG, start your research on-line or via recommendation using their company investors or skilled professionals. Once you see a beautiful class, take time to speak to its coordinator and comprehend their goals and risks along with capitalization level (also called "cover") in position - this proportion assists estimate expenditure house ideals and ought to perform an important role when creating choices about signing up for real estate wholesale or departing an REIG.

3. Real-estate Syndication

Real estate property syndications enable buyers to get exposure to the market without getting burdened with house advancement and management commitments on an ongoing foundation. Real estate property syndications involves an LLC composition made up of an energetic recruit who deals with investment capital increasing, acquisition, company planning for certain possessions passive brokers obtain distributions based on a waterfall construction with first funds contributions simply being distributed back and then handed out according to an excellent return objective (including 7Percent interior level of return (IRR).Buyers also enjoy taxes positive aspects in the expenditure package deal. Each year, they are offered a Plan K-1 displaying their revenue and loss to the syndication, along with devaluation write offs because of cost segregation and quicker depreciation of residence.

Expense trusts may be well suited for first-timers because of the reduced degree of risk in contrast to straight house buys. But remember that risk ranges depend upon every single scenario depending on factors like the neighborhood industry, property kind and business plan.

To create an educated decision about buying property syndications, it's essential that you perform research. This implies reviewing buyer materials such as venture management summaries, full purchase overviews, investor webinars and sponsor team track information. When prepared, reserve your place within the offer by putting your signature on and analyzing its PPM verify documentation reputation prior to cabling money into their profiles.

4. Home Flipping

Residence flipping is an exceptional way for amateur property brokers to make a profit by purchasing low and marketing great. Although this project will take lots of time and operate, if done efficiently it might prove highly worthwhile. Getting attributes with strong potential profit in regions people wish to reside is vital here additionally enough funds also needs to be set-aside as a way to complete restoration of stated home.For that https://en.wikipedia.org/wiki/?search=real estate reason, possessing a very clear strategic business plan is very important for identifying your targets and creating an action decide to complete them. Furthermore, possessing one functions as a helpful instrument when looking for brokers business plan templates on the net may aid in developing one swiftly.

Starting up tiny may help you alleviate into this type of investment much more easily, and will enable you to get to know its particulars more quickly. A powerful help community - such as companies, local plumbers, electricians and many others. will probably be essential.

Novice property investors could also take into account REITs, that are firms that own and deal with different qualities like hospitals, industrial environments, shopping malls, and home properties. Since they trade publicly about the supply exchange they are them reachable for starters.

Property investing might be highly gratifying should you do your homework and try these tips. Considering the variety of available alternatives, there has to be one excellent for you - but be wary never to overextend yourself financially before being completely ready if not it might lead to personal debt that can not be repaid.

5. House Hacking

Home hacking is undoubtedly an strategy to real estate property that requires acquiring and after that leasing back a portion of the purchased property to renters, delivering newbies with an perfect method to go into the market without committing too much in advance. Month-to-month rental income should deal with mortgage payments so it helps quickly build equity.Residence hacking can also provide an outstanding possibility to fully familiarize yourself with becoming a landlord, because you will bargain directly with tenants. Even so, be conscious that residence hacking can be an unforeseen purchase strategy sometimes leasing earnings won't include home loan repayments entirely each month. Well before plunging in headfirst using this committing strategy it is important that considerable market research be executed.

House hacking provides an additional benefit by helping minimize or perhaps eliminate homes charges totally. For example, purchasing a multifamily residence which has added products you are able to rent can certainly make located in it cheaper when another person pays off your home loan payments specifically.

Residence hacking requires living in your property you rent out therefore it is vital that you prefer living there long-term and feel at ease inside your surroundings. In addition, it's essential that you think about just how much job booking out one or more products in your home requires, including evaluating probable renters, accumulating lease monthly payments and handling renter issues.